What Are Retained Earnings? Definition Which Means Example

A consistently growing stability of retained earnings indicates a successful and growing business. It demonstrates that the company has generated income and successfully managed its assets. On the other hand, a stagnant or lowering steadiness would possibly suggest financial difficulties or poor performance. Investors usually contemplate retained earnings as an indicator of an organization’s capacity to reinvest in itself, fund future growth, or distribute dividends. Conversely, when dividends are paid out to shareholders, retained earnings decrease. Retained earnings are the portion of a company’s web income that is retained throughout the enterprise quite than distributed to shareholders as dividends.

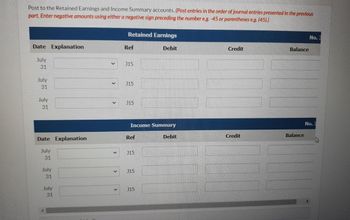

Net income will increase Retained Earnings, whereas internet losses and dividends lower Retained Earnings in any given yr. Thus, the steadiness in Retained Earnings represents the corporation’s accumulated web revenue not distributed to stockholders. When the retained earnings stability of an organization is unfavorable, it indicates that the company has generated losses instead of income over the interval of its existence. Most companies that have a adverse retained earnings stability are normally startups. This is as a end result of, at the beginning of the life of a enterprise, it is more than likely to incur losses because of the reality that its services and products have not yet gained market recognition.

When evaluating the different options for using retained earnings, it is essential to consider the corporate’s monetary position, market circumstances, and development potential. For a younger and rapidly increasing company, reinvesting retained earnings into the business might be the best choice. This permits the corporate to gas its development, develop new products, or enter new markets. On the opposite hand, mature companies with steady cash flows would possibly choose to distribute dividends to reward shareholders or repurchase shares to enhance shareholder worth. Retained earnings function a measure of an organization’s profitability and monetary stability.

Retained earnings (RE) are calculated by taking the beginning stability of RE and including internet revenue (or loss) and then subtracting out any dividends paid. After these earlier calculations are full, you may have your ending retained earnings. This number may even function your beginning determine for the following period’s balance sheet. For a brand-new enterprise that doesn’t have any prior balance sheets, your beginning earnings might be zero. An different to the assertion of retained earnings is the statement of stockholders’ fairness. Observe that a retained earnings appropriation does not scale back both stockholders’ fairness or whole retained earnings but merely earmarks (restricts) a portion of retained earnings for a specific reason.

What’s The Dunning Course Of In Accounting?

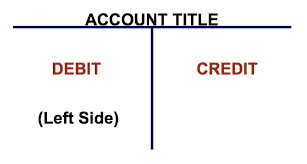

The double entry accounting system is based on the concept of debits and credits. For example, whenever you document a sale, it routinely debits your money or accounts receivable and credits your income account, so that you don’t should do it manually. This would possibly happen when you regulate or reverse the expenses you previously recorded.

How Do You Calculate Internet Asset Value? A Practical Instance

- You can discover retained earnings underneath the class of shareholder’s fairness in your balance sheet.

- In this text, you’ll be taught all about debits and credits in accounting, the means to manage debit and credit entries in your bookkeeping software, and tips on how to troubleshoot common debit and credit errors.

- Observing it over a period of time (for instance, over five years) solely signifies the pattern of how a lot money a company is adding to retained earnings.

- For an analyst, absolutely the figure of retained earnings throughout a specific quarter or 12 months may not provide any meaningful perception.

- In the context of accounting, retained earnings are normally a results of net earnings being added to the account.

In this case, this debit stability of retained earnings will be presented as a adverse in the balance sheet. Retained earnings check with the historical earnings earned by a company, minus any dividends it paid up to now. To get a greater understanding of what retained earnings can tell you, the following options broadly cowl all potential uses that an organization could make of its surplus cash. For instance, the primary possibility results in the earnings cash going out of the books and accounts of the enterprise eternally because dividend funds are irreversible. Debits and credit are utilized in every journal entry, and they determine the place a particular dollar quantity is posted within the entry. Your bookkeeper or accountant should know the forms of accounts your business makes use of and tips on how to calculate every of their debits and credit.

As A Outcome Of the company has not created any actual worth just by asserting a inventory dividend, the per-share market worth is adjusted based on the proportion of the inventory dividend. Merchants who look for short-term positive aspects may also choose dividend funds that offer immediate gains. It can reinvest this money into the enterprise for growth, working bills, research and growth, acquisitions, launching new merchandise, and more.

Retained Earnings Debit Or Credit?

In other words, evaluate your data to your financial institution stability to make sure every little thing matches. This course of helps spot errors early, like missed transactions or duplicate entries and can prevent small discrepancies from turning into larger issues. Liabilities, fairness, and income improve with credits and decrease with debits. Debits lower your fairness, often whenever you pay out dividends, experience losses, or withdraw funds from the enterprise. For instance, when you replenish on new inventory, more sources are coming into your organization. Retained earnings serve as a foundation for businesses by bolstering their financial base.

Some components that may affect a company’s retained earnings embrace depreciation, COGS, dividends, etc. The retained earnings are reported on the company’s stability sheet under its stockholder’s equity section https://www.simple-accounting.org/. This amount is often held in a reserve by the corporate and could be used to extend the company’s asset base or reduce a few of its liabilities.

Yes, retained earnings carry over to the following yr in the event that they haven’t been used up by the corporate from paying down debt or investing back in the company. Starting retained earnings are then included on the steadiness sheet for the next year. Extra paid-in capital does not immediately increase retained earnings but can result in larger RE in the long run. Further paid-in capital reflects the quantity of fairness capital that’s generated by the sale of shares of inventory on the primary market that exceeds its par value. At the top of 12 months three, Josh, Inc. has a $30,000 steadiness in its RE account (10,000 + 25,000 – 5,000).

Nonetheless, the previous earnings that haven’t been distributed as dividends to the stockholders will likely be reinvested in further income-producing assets or used to reduce the corporation’s liabilities. Instead of spending time on guide journal entries and locating errors, use accounting software program like QuickBooks. It connects on to your financial institution feed to accurately import every transaction, giving you more time to run your small business and make choices based on dependable, real-time monetary knowledge. It also can allow you to reconcile your bank accounts, generate monetary reviews, and maintain monitor of bills without all of the handbook work. Ultimately, the right accounting software may help you stay more organized, scale back errors, and offer you a greater picture of your company’s monetary health.